UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant þ |

Filed by a Party other than the Registrant o |

| | |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to 240.14a-12 |

| | |

| Diebold, Incorporated |

| | (Name of Registrant as Specified In Its Charter) |

| | |

| | (Name of Person(s) Filing Proxy Statement) |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| | |

| | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

5995 Mayfair Road

P. O. Box 3077 • North Canton, Ohio 44720-8077

March 13, 201311, 2015

Dear Shareholder:

The 20132015 Annual Meeting of Shareholders of Diebold, Incorporated will be held at the Sheraton Suites, 1989 Front Street, Cuyahoga Falls,Courtyard Marriott, 4375 Metro Circle NW, North Canton, Ohio 44221,44720, on Thursday, April 25, 201323, 2015 at 11:30 a.m. EDT.

As described in the accompanying Notice and Proxy Statement, at the Annual Meeting, you will be asked to (1) elect ten directors, (2) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 20132015, and (3) approve, on an advisory basis, our named executive officer compensation.compensation, and (4) approve the Diebold, Incorporated Annual Cash Bonus Plan.

Diebold isWe are pleased to continue to take advantage of the Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our Annual Meeting. Accordingly, Diebold iswe are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our 20132015 Proxy Statement and Annual Report for the year ended December 31, 20122014, and to vote online or by telephone. If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials on the Notice of Internet Availability of Proxy Materials.

All holders of record of Diebold, Incorporated common shares asat the close of business on February 25, 201327, 2015 are entitled to vote at the 20132015 Annual Meeting. You may vote online at www.proxyvote.com. If you received a paper copy of the proxy card by mail, you may also vote by signing, dating and mailing the proxy card promptly in the return envelope or by calling a toll-free number.

If you are planning to attend the meeting, directions to the meeting location are included on the back page. If you are unable to attend the meeting, you may listen to a replay that will be available on Diebold’sour web site at http://www.diebold.com. The replay may be accessed on Diebold’sour web site soon after the meeting and shall remain available for up to three months.

We look forward to seeing those of you who will be attending the meeting.

Sincerely,

|

| |

| |

HENRY D.G. WALLACE Executive Chairman of the Board

| |

|

| |

| |

ANDREAS W. MATTES President and Chief Executive Officer | |

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to be held on April 25, 201323, 2015.

This proxy statement, along with our Annual Report for the year ended December 31, 20122014, including exhibits, are available free

of charge at www.proxyvote.com (you will need to reference the 12-digit control number found on your proxy card

or Notice of Internet Availability of Proxy Materials in order to vote).

5995 Mayfair Road

P.O. Box 3077 • North Canton, Ohio 44720-8077

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 25, 201323, 2015

11:30 a.m. EDT

Dear Shareholder,Shareholder:

The Annual Meeting of Shareholders of Diebold, Incorporated will be held at the Sheraton Suites, 1989 Front Street, Cuyahoga Falls,Courtyard Marriott, 4375 Metro Circle NW, North Canton, Ohio 44221,44720, on April 25, 201323, 2015 at 11:30 a.m. EDT, for the following purposes:

| |

| 1. | To elect ten directors; |

| |

| 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 20132015; and |

| |

| 3. | To approve, on an advisory basis, our named executive officer compensation.compensation; and |

| |

| 4. | To approve the Diebold, Incorporated Annual Cash Bonus Plan. |

Your attention is directed to the attached proxy statement, which fully describes these items.

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Holders of record of Diebold common shares at the close of business on February 25, 201327, 2015 will be entitled to vote at the Annual Meeting.

The enclosed proxy card is solicited, and the persons named therein have been designated, by Diebold’s Board of Directors.

|

| | |

| | | By Order of the Board of Directors |

| | |

| | Chad F. HesseJonathan B. Leiken |

| | Senior Vice President, General CounselChief Legal Officer and Secretary |

March 13, 201311, 2015

(approximate mailing date)

You are requested to cooperate in assuring a quorum by voting online at www.proxyvote.com

or, if you received a paper copy of the proxy materials, by filling in, signing and dating the

enclosed proxy and promptly mailing it in the return envelope.

TABLE OF CONTENTS

DIEBOLD, INCORPORATED

5995 Mayfair Road

P.O. Box 3077 • North Canton, Ohio 44720-8077

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS, APRIL 25, 201323, 2015

General Information

This proxy statement is furnished to shareholders of Diebold, Incorporated in connection with the solicitation by the Board of Directors of proxies to be used at our 20132015 Annual Meeting of Shareholders, and any postponements or adjournments of the meeting.

These proxy materials are being sent to our shareholders on or about March 13, 201311, 2015.

Questions and Answers

|

| | |

| Q: | | When and where is the Annual Meeting? |

| | | |

| A: | | The 20132015 Annual Meeting will be held at the Sheraton Suites, 1989 Front Street, Cuyahoga Falls,Courtyard Marriott, 4375 Metro Circle NW, North Canton, Ohio 44221,44720, on April 25, 2013,23, 2015, at 11:30 a.m. EDT. |

| | | |

| Q: | | What items will be voted on at the Annual Meeting? |

| | | |

| A: | | At the Annual Meeting, you are being asked to: |

| | | |

| | | • Elect ten directors; |

| | | |

| | | • Ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2013; andthe year ending December 31, 2015; |

| | | |

| | | • Approve, on an advisory basis, our named executive officer compensation.compensation; and |

| | |

| | • Approve the Diebold, Incorporated Annual Cash Bonus Plan. |

| | | |

| | | If a permissible proposal other than the listed proposals is presented at the Annual Meeting, your proxy gives authority to the individuals named in the proxy to vote on any such proposal in accordance with their best judgment. We have not received notice of other matters that may be properly presented at the Annual Meeting. |

| | | |

| Q: | | Who is entitled to vote at the Annual Meeting? |

| | | |

| A: | | Our record date for the 20132015 Annual Meeting is February 25, 2013.27, 2015. Each shareholder of record of our common shares as of the close of business on February 25, 201327, 2015 is entitled to one vote for each common share held. As of the record date, there were 63,340,49664,824,932 common shares outstanding and entitled to vote at the Annual Meeting. |

| | | |

| Q: | | How do I vote? |

| | | |

| A: | | If you were a shareholder on the record date and you held shares in your own name, you have three ways to vote and submit your proxy before the 2015 Annual Meeting: |

| | | |

| | | • By mail – You may vote by completing, signing and returning the proxy card that you will receive in the mail; |

| | | |

| | | • By Internet – We encourage you to vote and submit your proxy online at www.proxyvote.com. Even if you request and receive a paper copy of the proxy materials, you may vote online by going to www.proxyvote.com and entering your control number, which is a 12 digit number located in a box on your proxy card that you willcan also receive in the mail;mail, if requested; or |

| | | |

| | | • By telephone – You may vote and submit your proxy by calling 1-800-690-6903 and providing your control number, which is a 12-digit number located in a box on your proxy card that you willcan also receive in the mail.mail, if requested. |

| | | |

| | | If you complete and submit a proxy card, the persons named as proxies on your proxy card, which we refer to as the Proxy Committee, will vote the shares represented by your proxy in accordance with your instructions. If you submit your proxy card but do not indicate your voting preferences, the Proxy Committee will vote according to the recommendation of the Board. |

|

| | |

| Q: | | How does the Board recommend I vote? |

| | | |

| A: | | The Board recommends a vote: |

| | | |

| | | • FOR each of our ten nominees for director; |

| | | |

| | | • FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2013;the year ending December 31, 2015; |

| | |

| | • FOR the approval, on an advisory basis, of our named executive officer compensation; and |

| | | |

| | | • FOR the approval of our named executive officer compensation.the Diebold, Incorporated 2015 Annual Cash Bonus Plan. |

| | | |

| Q: | | Can I change my vote after I have voted? |

| | | |

| A: | | You may change your vote at any time before your proxy is voted at the 2015 Annual Meeting by: |

| | | |

| | | • Revoking your proxy by sending written notice or submitting a later dated, signed proxy before the 2015 Annual Meeting to our Corporate Secretary at the company’sCompany’s address above; |

| | | |

| | | • Submitting a later dated, signed proxy before the start of the 2015 Annual Meeting; |

| | | |

| | | • If you have voted by the Internet or by telephone, you may vote again over the Internet or by telephone byup until 11:59 p.m. EDT on April 24, 2013;22, 2015; or |

| | | |

| | | • Attending the 2015 Annual Meeting, withdrawing your earlier proxy and voting in person. |

| | | |

| Q: | | What is cumulative voting and how can I cumulate my votes for the election of directors? |

| | | |

| A: | | In cumulative voting, each shareholder may cast a number of votes equal to the number of shares owned multiplied by the number of directors to be elected, and that number of the votes may be cast all for one director-nominee only or distributed among the director-nominees. |

| | | |

| | | In order to cumulate votes for the election of a director, a shareholder must give written notice to our Executivenon-executive Chairman, any Vice President or our Corporate Secretary no later than 9:5911:29 a.m. EDT on April 23, 201321, 2015 that the shareholder desires that the voting for the election of directors be cumulative, and if an announcement of such notice is made upon convening the Annual Meeting by the Chairman or Corporate Secretary of the meeting, or by or on behalf of the shareholder giving the notice, each shareholder will have cumulative voting. |

| | | |

| | | We have received written notice from a shareholder that ithe desires that cumulative voting be in effect for the election of directors. Accordingly, unless contrary instructions are received on the enclosed proxy, it is presently intended that all votes represented by properly executed proxies will be divided evenly among the director-nominees. However, if voting in such manner would not be effective to elect all such director-nominees, votes will be cumulated at the discretion of the Proxy Committee so as to maximize the number of such director-nominees elected. |

| | | |

| Q: | | How many votes are required to adopt each proposal? |

| | | |

| A: | | For Proposal 1, the director-nominees receiving the greatest number of votes will be elected, subject to our Majority Voting Policy described below. For each of Proposals 2, 3 and 3,4, the affirmative vote of the holders of a majority of the votes cast, whether in person or by proxy, is required for approval. The results of the voting at the meeting will be tabulated by the inspectors of election appointed for the Annual Meeting. |

| | | |

| Q: | | What is the Majority Voting Policy? |

| | | |

| A: | | Votes withheld with respect to the election of directors will not be counted in determining the outcome of that vote. However, ourOur Board of Directors has adopted a policy that any director-nominee thatwho is elected but receives a greater number of votes withheld from his or her election than votes in favor of election is expected to tender his or her resignation following certification of the shareholder vote, as described in greater detail below under “Majority Voting Policy.”

|

| | | |

| Q: | | What is a “broker non-vote?” |

| | | |

| A: | | If your shares are held in the name of a brokerage firm, your shares may be voted even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under the New York Stock Exchange, or NYSE, rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter under NYSE rules and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is referred to as a “broker non-vote.” |

|

| | |

| | | |

| | | Proposal 2, the ratification of KPMG LLP as our independent registered public accounting firm for the year 2013,ending December 31, 2015, is the only routine matter for which the brokerage firm who holds your shares can vote your shares on these proposals without your instructions. Accordingly, there should be no broker non-votes with respect to Proposal 2. Broker non-votes will have no effect on the outcome of Proposal 3.Proposals 1, 3 or 4. |

| | | |

| Q: | | How many shares must be present to constitute a quorum and conduct the Annual Meeting? |

| | | |

| A: | | A quorum is necessary to hold the Annual Meeting. A majority of the outstanding shares present or represented by proxy constitutes a quorum for the purpose of adopting a proposal at the Annual Meeting. If you are present and vote in person at the Annual Meeting, or vote on the Internet, by telephone or by submitting a properly executed proxy card, you will be considered part of the quorum. Broker non-votes will not be part of the voting power present, but will be counted to determine whether or not a quorum is present. |

| | | |

| Q: | | What happens if I abstain? |

| | | |

| A: | | A share voted “abstain” with respect to any proposal is considered as present and entitled to vote with respect to the proposal, but is not considered a vote cast with respect to the proposal. Accordingly, for Proposal 1, abstentions will have no effect on the election of directors, except in regards to the Majority Voting Policy described above.below. For Proposals 2, 3 and 3,4, abstentions will not be counted for determining the outcome of these proposals. |

| | | |

| Q: | | Why did I receive a one-page notice in the mail regarding Internet availability of proxy materials instead of a full set of proxy materials? |

| | | |

| A: | | Under rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide access to our proxy materials on the Internet. Accordingly, we are sending you a Notice of Internet Availability of Proxy Materials. The instructions found in the notice explain that all shareholders will have the ability to access the proxy materials on www.proxyvote.com or request to receive a printed copy of the proxy materials. You may also request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Diebold encourages you to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our Annual Meeting. |

| | | |

| Q: | | What shares are included on my proxy card or Notice of Internet Availability of Proxy Materials? |

| | | |

| A: | | The number of shares printed on your proxy card(s) represents all your shares under a particular registration. Receipt of more than one proxy card or Notice of Internet Availability of Proxy Materials means that certain of your shares are registered differently and are in more than one account. If you receive more than one proxy card, sign and return all your proxy cards to ensure that all your shares are voted. If you receive more than one Notice, reference the distinct 12-digit control number on each Notice when voting by Internet. |

TABLE OF CONTENTS

CORPORATE GOVERNANCE

Board Leadership Structure

We currently separateSince 2006, we have separated the permanent roles of our Chief Executive Officer, or CEO, and our Chairman of the Board; however, inBoard. The Company intends to maintain the past, we have combined them. The Board initially separated the roles in 2005 to allow ourseparation between its CEO at the time to concentrate on re-aligning our business priorities and running our business operations as we transitioned to new leadership. We currently intend to keep these roles separate. However, as disclosed in our Current Report on Form 8-K filed on January 24, 2013, Thomas W. Swidarski, our former CEO, stepped down from that position and from the Board effective January 19, 2013. In addition, John N. Lauer, our prior Chairman of the Board is retiring frompositions for the Board effective as of the 2013 Annual Meeting. To provide for essential executive management of the company until a permanent CEO is appointed,time being and to allow for effective transition of the Chairman position prior to the 2013 Annual Meeting, the Board nominated and appointed Henry D.G. Wallace to temporarily serve as Executive Chairman of the Board, effective January 19, 2013.

Upon the appointment of a permanent CEO, Mr. Wallace will become our non-executive Chairman of the Board, in addition to his other Board committee appointments. Also following the appointment of a permanent CEO, the Board intends to maintain separation of the permanent CEO and Chairman roles at least through 2015. Otherwise, the Board does not have a specific policy with respect to separating versus combining these roles, or whether the Chairman should be an employee or non-employee director. As such, the Board, primarily under the guidance of the Board Governance Committee, will continue to periodically review our leadership structure to determine whether to maintain this separation after 2015 in light of applicable corporate governance standards, market practices, our specific circumstances and needs, and any other factors that may be relevant to the analysis.

Board and Director Assessments

The Board Governance Committee oversees the Board and director assessment program, as noted below in “Board Committees and Composition.” When taken together, the following assessment program provides a holistic review of the role, performance and function of the full Board, the Chairman and each director, in relation to the Company’s needs, challenges and opportunities. The assessment program includes:

•Full Board Self-Assessment. Annual self-assessment that includes a comprehensive questionnaire including a wide-range of topics designed to provide a holistic evaluation of the performance of the Board in light of the needs of the Company. Each director is required to complete the questionnaire. The results are reviewed and discussed by the Board Governance Committee, and any proposed actions are then reported to the full Board of Directors.

•Committee Assessments. Annual assessment of each Board Committee’s performance over the prior year, as led by the applicable Committee Chair. Results are reviewed by the respective Committee Chairs, and discussed with the applicable Committee members, and any proposed actions are then reported to the full Board of Directors.

•Chairman Assessment. Annual assessment of the Chairman of the Board that includes a comprehensive questionnaire including relevant topics necessary to provide a thorough analysis of the Chairman’s performance and role in leading the Board in its responsibilities and obligations. Each director completes the questionnaire anonymously. The results are reviewed by the Chairman and the Board Governance Committee, and any proposed actions are then reported to the full Board of Directors.

•Individual Director Assessment. Annual assessment of each individual director, including of themselves, that includes a comprehensive questionnaire including relevant topics necessary to provide a thorough analysis of each director’s performance on the Board. Each director completes the questionnaires anonymously with respect to the other directors. The results are reviewed by the Chairman who delivers feedback to each individual director.

Board Meetings and Executive Sessions

During 20122014, the Board held five meetings. Except formeetings in person. With the exception of Mr. Soin,Artavia, all of our current directors attended 75% or more of the aggregate of all meetings of the Board and the Board committees on which they served during 20122014. Due to scheduling conflicts with other professional obligations, Mr. Soin joined the Board at the April 2012 Annual Meeting of Shareholders, andArtavia attended 66% of the three 2012aggregate of the total Board and committee meetings that took place following his appointment,on which he missed one due to a previously scheduled conflict.served in 2014.

In accordance with the NYSE’s corporate governance standards, our independent directors regularly meet in executive session without management present, generally following each regularly-scheduled Board meeting. In addition, on occasion, our independent directors will meet in executive session prior to the start of a Board meeting. Our Chairman of the Board during 2012, John N. Lauer, was an independent director and presided over executive sessions. Mr. Lauer was unable to attend one Board meeting, in December 2012, and delegated his Chairman responsibilities and oversight obligations for that Board meeting to Henry D.G. Wallace, who,

While Diebold does not have a formal policy regarding directors’ attendance at the time, was also an independent director.Annual Meeting of Shareholders, it is expected that all directors attend the 2015 Annual Meeting unless there are extenuating circumstances for nonattendance. All directors standing for re-election attended the 2014 Annual Meeting of Shareholders.

Board Risk Oversight

The Board and the Board committees collectively haveplay an active role in overseeing management of the company’sCompany’s risks, and in helping the companyCompany establish an appropriate risk tolerance. The Board oversees the company’sCompany’s risk strategy and effectiveness; however, management is responsible for identifying risks inherent in our business, as well as implementing and supervising day-to-day risk management. Accordingly, the Board and the appropriate committees receive regular reports from our senior management on areas of material risk to us, including operational, financial, strategic, compliance, competitive, reputational, legal and regulatory risks. The Board also meets with senior management at least annually, for a two-dayas part of each Board meeting, and more frequently as needed, to discuss strategic planning, session and discussion ofincluding the key risks inherent in our short- and long-term strategies at the development stage.strategies. Senior management then provides the Board with periodic updates throughout the year with respect to these strategic initiatives, and the impact and management of these key risks.

In addition, each Board committee is responsible for evaluating certain risks within its area of responsibility and overseeing the management of such risks. The entire Board of Directors is then informed about such risks and management’s response to each onerisk through regular committee reports delivered by the committee chairs. Below is a summary of the risk oversight roles of each committee:

Board Governance Committee Risk Oversight

As reported in our proxy statement for our 2012 Annual Meeting of Shareholders, the Board and management created the Diebold Risk Council, or DRC, in 2011 in order to better align our efforts of identifying, assessing, managing and monitoring enterprise-wide risks, and to better coordinate our risk management decisions, practices, policies and activities across the company. In 2012, the Board Governance Committee assumed the primary oversight responsibility for enterprise risk management generally, including oversight of the DRC. The DRC receives regular reports from the other management

committees, as noted under “Other Risk Oversight” below, and provides for regular and consistent communications among our senior management and the Board, primarily through the Board Governance Committee.

In addition, the Board Governance Committee manages risks associated with the independence of our Board, corporate governance and potential conflicts of interest.

Audit Committee Risk Oversight

Our Audit Committee regularly reviews our financial statements, internal controls over financial reporting (among other areas), as well as the effectiveness of our internal controls and the status of any efforts that may be required to remediate internal control deficiencies identified by management or our independent auditors. In evaluating the effectiveness of our internal controls, the Audit Committee relies on the advice and counsel of our independent auditors to identify risks that arise during their regular reviews of our financial statements, and reports to the Board following each regularly scheduled Audit Committee meeting. The Audit Committee also has primary responsibility for the initial review of any credible ethics complaints disclosed pursuant to our Code of Business Ethics, discussed further in “Code of Business Ethics” below.

Compensation Committee Risk Oversight

Our Compensation Committee regularly reviews our executive compensation policies and practices, and employee benefits, and the risks associated with each. At the request of our Compensation Committee, management also reviews and evaluates our compensation policies and practices applicable to all employees that may create risks for our company. This evaluation includes reviews by members of our human resources, legal, finance and internal audit departments. The Compensation Committee also engages its independent compensation consultant to conduct a comprehensive risk assessment of our executive compensation policies and practices, discussed in detail below under “Compensation Discussion and Analysis,” and the results of these reviews and assessments are presented to the Compensation Committee for its review and final assessment. As a result, we have determined that our compensation policies and practices do not create risk that is reasonably likely to have a material adverse effect on the company.

As described in more detail below under “Compensation Discussion and Analysis,” our Compensation Committee has developed an executive compensation philosophy that does not encourage unnecessary or excessive risk taking. Executives’ base salaries are fixed in amount, bonuses are capped and tied to corporate performance, and a large portion of executives’ compensation is provided in the form of long-term equity awards, the value of which are ultimately tied to the price of our common shares, all of which help to align executives’ interests with our shareholders.

Other Risk Oversight

Our Investment Committee oversees the management of risks associated with our credit, liquidity, investments and related strategies.

In addition, we have numerous management committees tasked in part with reviewing risks and potential risks related to their respective day-to-day functional areas. These management committees meet regularly and report their results to the full Board of Directors or applicable committee.Chairs.

We also have robust internal dialog amongstamong our operations, finance, compliance, treasury, tax, legal and internal audit departments, among others, whenever a potential risk arises. These discussions are escalated to our CEO, CFO,Chief Financial Officer, Chief Operating Officer, Corporate Controller, Chief Legal Officer, Chief Ethics and Compliance Officer, General Counsel, Chief Human Resources Officer, Chief InnovationCommunications Officer, and/or Vice President, Internal Audit and other Vice President leads of our various divisions and regions, as appropriate, with open lines of communication among them, the various management committees described above, the various committees of the Board and the entire Board.

We believe that the Board’s approach and continued evaluation of its risk oversight, as described above, optimizes its ability to assess the various risks, make informed cost-benefit decisions, and approach emerging risks in a proactive manner for Diebold. We also believe that our Board leadership structure complements our risk management structure because it allows our independent directors to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

Board Committees and Composition

The Board’s current standing committees are the AuditBoard Governance Committee, Board GovernanceAudit Committee, Compensation Committee and Investment Committee. In addition, in 2010, the Board formed a Special Committee to oversee the Board’s legal representative in connection with our previously disclosed global Foreign Corrupt Practices Act, or FCPA, review. In January 2013, following Mr. Swidarski’s departure,2014, the Board also formed a CEO SearchTechnology Strategy & Innovation Committee, to identify and evaluate potential CEO candidates. Belowwhich is discussed further below. The following is a summary of our committee structure and membership information:membership:

_______________________________________________________

| |

1

| Mr. Allender moved off of the Compensation Committee, and on to the Audit and Board Governance Committees, effective as of April 26, 2012. In addition, he assumed the Chair of our Audit Committee upon Mr. Wallace’s appointment as our Executive Chairman of the Board, effective as of January 19, 2013. |

| |

2

| Mr. Cheng is not standing for reelection at the 2013 Annual Meeting. |

| |

3

| Mr. Lassiter retired from the Board effective as of the April 2012 Annual Meeting of Shareholders. |

| |

4

| Mr. Lauer will be retiring from the Board and not standing for reelection at the 2013 Annual Meeting. |

| |

5

| Mr. Soin was elected to the Board at the 2012 Annual Meeting of Shareholders and appointed to the Compensation Committee effective as of April 26, 2012. |

| |

6

| In 2012, Mr. Wallace served as Chair of our Audit Committee, but stepped down from that position and from the Audit Committee effective January 19, 2013, when he was appointed Executive Chairman of the Board. |

Audit Committee

This committee is a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, or the Exchange Act, and its functions are described below under “Report of Audit Committee.” The committee’s current charter is available on our web site at http://www.diebold.com.

The current members of the Audit Committee are Patrick W. Allender, Chair, (effective as of January 19, 2013),Roberto Artavia, Bruce L. Byrnes, Mei-Wei Cheng,Robert S. Prather, Jr., and Alan J. Weber, all of whom are independent.independent under the NYSE Rules and applicable SEC requirements. In addition, the Board has determined that Messrs. Allender and Weber are audit committee financial experts. During 2012, Mr. Wallace served as Chairexperts within the meaning of the Audit Committee, but effective assuch term under Item 407(d)(5) of January 19, 2013, when he was appointed Executive Chairman of the Board, he stepped down as Chair and as a member of the Audit Committee.Regulation S-K. This committee met in person or telephonically eight times during 20122014, and had informal communications between themselves and management, as well as with our independent auditors, at various other times during the year.

Board Governance Committee

This committee’s functions include reviewing the qualifications of potential director candidates and making recommendations to the Board to fill vacancies or consider the appropriate size of the Board. This committee makes recommendations regarding corporate governance principles, the composition of the Board committees, and the directors’ compensation for their services on the Board and on Board committees. This committee also leads and oversees all of the Board’s annual self-assessment,Board assessments, including the Committee assessments with respect to process and design, as described above in “Board and Director Assessments.” This committee also oversees director orientation and education, as described in “Director Orientation and Education” below. Finally, as noted in “Board Risk Oversight” above, in 2012 this committee assumed the primary oversight of enterprise risk management generally and of the DRC. The committee’s current charter is available on our web site at http://www.diebold.com.

The current members of the Board Governance Committee are Gale S. Fitzgerald, Chair, Patrick W. Allender, Bruce L. Byrnes, Mei-Wei Cheng,Rajesh K. Soin and John N. Lauer,Henry D. G. Wallace, all of whom are independent. This committee met in person or telephonically sixfive times during 20122014., and had informal communications between themselves and management at various other times during the year.

Compensation Committee

This committee administers our executive pay program. The committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee or, in the case of non-officers, to the CEO or the Chief Human Resources Officer. The role of the committee is to oversee our equity plans (including reviewing and approving equity grants to executive officers) and to annually review and approve all pay decisions relating to executive officers. This committee also assessesdetermines and measures achievement of corporate and individual goals, as applicable, by the executive officers under our short- (annual) and long-term incentive plans, and makes recommendations to the Board for approvalratification of such achievement.achievements. This committee reviews the management succession plan and proposed changes to any of our benefit plans, such as retirement plans, deferred compensation plans and 401(k) plans. For a narrative description of the committee’s processes and procedures for the consideration of executive officer compensation, and for further discussion on the independence of the committee members, see “Compensation Discussion and Analysis” below. The committee’s current charter is available on our web site at http://www.diebold.com.

The current members of the Compensation Committee are Phillip R. Cox, Chair, Richard L. Crandall, Gale S. Fitzgerald, John N. Lauer, and Rajesh K. Soin and Henry D. G. Wallace, all of whom are independent.independent under the NYSE rules and applicable SEC requirements. This committee met in person or telephonically fivefour times during 20122014., and had informal communications between themselves and management, as well as the Committee’s independent compensation consultant, at various other times during the year.

Investment Committee

This committee’s functions include establishing the investment policies, including asset allocation, for our cash, short-term securities and retirement plan assets, overseeing the management of those assets, ratifying fund managers recommended by management and reviewingassessing at least annually the investment performance of our retirement plans and 401(k) plans to assure adequate and competitive returns.plans. The committee’s current charter is available on our web site at http://www.diebold.com.

The current members of the Investment Committee are Alan J. Weber, Chair, Phillip R. Cox Richard L. Crandall and Henry D. G. Wallace. This committee met once in 2012.

Special Committee

This committee’s functions are to oversee the Board’s legal representative in connection with our previously disclosed global FCPA review. The committee has the authority to retain independent counsel, and may conduct any interviews with officers, employees and/or directors of the company and access all information of the company or our subsidiaries that it believes will assist in its activities.

The current members of the Special Committee are Henry D. G. Wallace, Chair, Phillip R. Cox, GaleRobert S. Fitzgerald and Alan J. Weber.Prather, Jr. This committee met in person or telephonically five timesonce in 20122014, and had informal communications between themselves and management at various other times during the year.

Technology Strategy and Innovation Committee

Upon the recommendation of the Board Governance Committee, this committee was formed by the Board in April 2014, and its functions include overseeing the Company’s technology goals and strategies. Specifically, the committee focuses on overseeing strategies regarding innovation, competitive differentiation, customer and market understanding, research and development and engineering programs, security and privacy dimensions, as well as partnering and acquisition proposals. The committee’s current charter is available on our web site at http://www.diebold.com.

CEO Search Committee

This Committee was formed immediately following Mr. Swidarski’s departure from the company in January 2013 in order to begin the process of hiring a permanent CEO. This committee’s functions include identifying and evaluating potential CEO candidates, and ultimately advising the Board on its recommendations for hiring a CEO. This committee is also responsible for preparing a development plan for George S. Mayes, Jr., as a result of his appointment as Executive Vice President and Chief Operating Officer in January 2013, and his management team.

The members of this committeethe Technology Strategy and Innovation Committee are Richard L. Crandall, Chair, Phillip R. CoxRoberto Artavia and Rajesh K. Soin.Gary G. Greenfield. This committee met in person or telephonically three times in 2014.

Director Independence

The Board determined that each of Patrick W. Allender, Roberto Artavia, Bruce L. Byrnes, Mei-Wei Cheng, Phillip R. Cox, Richard L. Crandall, Gale S. Fitzgerald, John N. Lauer,Gary G. Greenfield, Robert S. Prather, Jr., Rajesh K. Soin, Henry D. G. Wallace and Alan J. Weber, which includes each of the members of the Audit Committee, the Board Governance Committee and the Compensation Committee, has no material relationship with Diebold (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) and is independent withinunder our director independence standards, which reflect the NYSE director independence standards, and the SEC independence requirements, as applicable and as currently in effect.

In making this determination with respect to Mr. Crandall, the Board determined that the provision of our printing services related to our proxy statement provided by R.R. Donnelley & Sons Company, the board of directors of which Mr. Crandall is a member, did not create a material relationship or impair the independence of Mr. Crandall because he serves only as a board member, and the nature of the services provided and the fees paid by Diebold for such services were less than $25,000 in 2012.

Further, in making this determination with respect to Mr. Weber, the Board determined that the provision of our proxy processing, mailing and tabulation services by Broadridge Financial Solutions, Inc., the board of directors of which Mr. Weber is a member, did not create a material relationship or impair the independence of Mr. Weber because he serves only as a board member, and the nature of the services provided and the fees paid by Diebold for such services were less than $90,000 in 2012.

Under our director independence standards, a director will be determined not to be independent under the following circumstances:

The director is, or has been within the last three years, an employee of ours, or an immediate family member is, or has been within the last three years, an executive officer of ours;

The director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service);

The director has been affiliated with or employed by, or any of his or her immediate family members has been affiliated with or employed in a professional capacity by, a present or former internal or external auditor of the company during the last three years;

The director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of our present executive officers at the same time serves or served on that company’s compensation committee;

The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, us for property or services in an amount which, in any of the last

three fiscal years, exceeds the greater of $1 million, or two percent of such other company’s consolidated gross revenues;

The director has engaged in a transaction with us for which we have been or will be required to make a disclosure under Item 404(a) of Regulation S-K promulgated by the SEC; or

The director has any other material relationship with us, either directly or as a partner, shareholder or officer of an organization that has a relationship with us.

Thomas Andreas W. Swidarski, who was a member of our Board in 2012, didMattes does not meet these independence standards because he wasis employed as our President and CEO, and our employee, through January 19, 2013. Further, Mr. Wallace does not currently meet these standards as our current Executive Chairman of the Board, effective January 19, 2013; however, Mr. Wallace will regain his independent status and become a non-executive director once we hire a permanent CEO.

Our director independence standards are available on our web site at http://www.diebold.com.

In making the independence determinations, the Board considered the following:

Mr. Crandall serves on the board of directors of R.R. Donnelley & Sons Company, which provided printing services related to our proxy statement for our 2014 annual meeting of shareholders for a fee of approximately $31,000. The Board determined that the provision of these services and Mr. Crandall’s board membership did not create a material relationship or impair the independence of Mr. Crandall.

Mr. Weber serves on the board of directors of Broadridge Financial Solutions, Inc., which provided processing, mailing and tabulation services for our proxy statement in 2014 for a fee of approximately $154,000. The Board determined that the provision of these services and Mr. Weber’s board membership did not create a material relationship or impair the independence of Mr. Weber.

Mr. Cox serves as President and CEO of Cox Financial Corporation, which may act as the broker with respect to certain supplemental disability benefits purchased by our employees, at their own expense and election, from certain insurance companies. Diebold is not a client or customer of Cox Financial Corporation and does not participate in the employee’s decision. To date, Cox Financial has not received any remuneration as a result of these brokerage services. The Board determined that the provision of these brokerage services to our employees, at their own expense and election, for purposes of their long term disability insurance coverage, did not create a material relationship or impair the independence of Mr. Cox.

Related Person Transaction Policy

Pursuant to our director independence standards, discussed above, and our Corporate Governance Guidelines, discussed below in “Board Diversity, Director Qualifications and Corporate Governance Guidelines,” we do not engage in transactions with non-employee directors or their affiliates if a transaction would cause an independent director to no longer be deemed independent, would present the appearance of a conflict of interest or is otherwise prohibited by law, rule or regulation. This includes, directly or indirectly, any extension, maintenance or renewal of an extension of credit to any of our directors.

This prohibition also includes significant business dealings with directors or their affiliates, charitable contributions that would require disclosure in our proxy statement under the rules of the NYSE, and consulting contracts with, or other indirect forms of compensation to, a director. Any waiver of this policy may be made only by the Board and must be promptly disclosed to our shareholders.

Both the director independence standards and ourOur Corporate Governance Guidelines are available on our website at www.diebold.com.

In 20122014, we did not engage in any related person transaction(s) requiring disclosure under Item 404 of Regulation S-K.

Communications with Directors

Shareholders and interested parties may communicate with our committee chairs or with our non-employee directors as a group, by sending an email to:

Audit Committee – auditchair@diebold.com

Board Governance Committee – bdgovchair@diebold.com

Compensation Committee – compchair@diebold.com

Independent Directors – nonmanagementdirectors@diebold.com

Communications may also be directed in writing to such person or group at Diebold, Incorporated, Attention: Corporate Secretary, 5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio 44720-8077. The Board has approved a process for handling communications received by the company andwe receive that are addressed to non-employee members of the Board. Under that process, the Corporate Secretary will review all such communications and determine whether communications require immediate attention. The Corporate Secretary will forward communications, or a summary of communications, to the appropriate director or directors.

A majority of the independent directors of the Board approved this process for determining which communications are forwarded to various members of the Board.

Code of Business Ethics

All of our directors, executive officers and employees are required to comply with certain policies and protocols concerning business ethics and conduct. Effective November 21, 2012, we implemented a newconduct as provided in our Code of Business Ethics, or the Code. The Code which replaced our prior Business Ethics Policy, as reflected in our Current Report on Form 8-K filed on November 28, 2012. The new Code was implemented as part of our ongoing mission to improve and expand our ethics and compliance culture by tyingties our core values to the ethical principles that must guide our business decisions. OurThe Code also provides clear information on the resources available for directors, executive officers and employees to ask questions and report unethical behavior. All members of the Board have received training specific to the Code.

OurThe Code applies not only to the company,us, but also to all of our domestic and international affiliates and subsidiaries. The Code describes certain responsibilities that our directors, executive officers and employees have to Diebold, to each other and to our global partners and communities. It covers many topics, including compliance with laws, including the Foreign Corrupt Practices Act and relevant global anti-corruption laws, conflicts of interest, intellectual property and the protection of competitive and confidential information, as well as maintaining a respectful and non-retaliatory workplace. The Code also includes and links to our Conflicts of Interest Policy, which further details the requirements for our officers, directors and employees to avoid and disclose potential conflicts, including those that may result from related-party transactions. In addition, our employees are required to report any conduct that they believe in good faith to be a violation of ourthe Code. Our Audit Committee has procedures to receive, retain and treat complaints received regarding accounting, internal financial controls or auditing matters, and to allow for the confidential and anonymous submission of concerns regarding questionable practices or potential violations of our policies, including ourthe Code.

The Code of Business Ethics is available on our web site at http://www.diebold.com.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during the year ended December 31, 20122014 were Phillip R. Cox, Chair, Patrick W. Allender (through April 25, 2012), Richard L. Crandall, Gale S. Fitzgerald, John N. Lauer, and Rajesh K. Soin who was appointedand Henry D. G. Wallace. Except with respect to Mr. Wallace’s temporary executive status during the Committee following his election toperiod between our prior CEO stepping down in January 2013 until Mr. Mattes assumed the Board atchief executive officer role (as previously disclosed in our 2012 Annual Meeting of Shareholders. No2014 annual proxy statement), no member of the Compensation Committee is or has been an executive officeremployee of the company, andDiebold. In addition, no member of the Compensation Committee has had any relationships requiring disclosure by the companyus under the SEC’s rules requiring disclosure of certain relationships and related person transactions. No officer or employee of the companyDiebold served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director of the companyDiebold or member of ourthe Compensation Committee during 20122014.

Director Orientation and Education

All new directors participate in a director orientation program. The Board Governance Committee oversees this introduction and orientation process where the new director meets with key senior management personnel and takes a tour through our global solutions center to improve his or her understanding of the company to thoroughly understand our business.business and global products and solutions. In addition, the orientation process educates the new director on our strategic plans, significant financial matters, core values, including ethics and compliance programs (and also including our Code of Business Ethics), corporate governance practices and other key policies and practices.

COMPENSATION OF DIRECTORS

The following director compensation is determined by the Board at the recommendation of the Board Governance Committee. With respect to non-employee directors, it is the company’sour goal to provide directors with fair and competitive compensation, while ensuring that their compensation is closely aligned with stockholder interests and with our performance.

The annual retainer received by the performance ofdirectors during 2014 remained the company.

During 2012,same as those paid in 2013. Accordingly, during 2014, our non-employee directors received an annual retainer of $65,000 for their service as directors, and ourdirectors. Our non-executive Chairman of the Board received an additional annual retainer of $7,500 per month. $100,000 (increased from $90,000 effective May 1, 2014).

In addition to their annual retainers, our non-employee directors also received the following annual committee fees for their participation as members or as Chairs of one or more Board committees:

|

| | | | | | | | |

| | Member | | Chair | |

| Audit Committee | $ | 11,000 |

| | $ | 15,000 |

| |

| Compensation Committee | $ | 7,000 |

| | $ | 12,000 |

| |

| Board Governance Committee | $ | 5,000 |

| | $ | 8,000 |

| |

| Investment Committee | $ | 3,000 |

| | $ | 5,000 |

| |

Additionally, members of the Special Committee also received $1,500 for each Special Committee meeting held and the Chair of the Special Committee received a $10,000 annual retainer in addition to the per meeting fee. |

| | | | | | | |

| | Member | | Chair |

| Audit Committee | $ | 11,000 |

| | $ | 25,000 |

|

| Compensation Committee | $ | 7,500 |

| | $ | 20,000 |

|

| Board Governance Committee | $ | 7,500 |

| | $ | 15,000 |

|

| Investment Committee | $ | 3,000 |

| | $ | 10,000 |

|

| Technology Strategy and Innovation Committee | $ | 7,500 |

| | $ | 15,000 |

|

The varying fee amounts are intended to reflect differing levels of responsibility, meeting requirements and fiduciary duties. The fees for a director who joins or leaves the Board or assumes additional responsibilities during the year are pro-rated for his or her period of actual service.

A director may elect to defer receipt of all or a portion of his or her cash compensation pursuant to the Deferred Compensation Plan No. 2 for Directors.

In addition to cash compensation, each non-employee director may also receive equity awards under our Amended and Restated 1991 Equity and Performance Incentive Plan, as amended and restated on February 12, 2014, which we refer to as the 1991 Plan. The aim of the Board is to provide a balanced mix of cash and equity compensation to our directors which mixthat targets the directors’ total pay at the median of a peer group of companies in similar industries and of comparable size and revenue. This peer group is the same one used by our Compensation Committee for benchmarking executive compensation, which is discussed in more detail below in “Peer Companies and Competitive Market Data” under “Compensation Discussion and Analysis.”

Prior to 2007, our non-employee directors received stock option awards under the 1991 Plan. Those stock options that vested prior to December 31, 2005 are entitled to reload rights, under which an optionee can elect to pay the exercise price using previously owned shares and receive a new option at the then-current market price for a number of shares equal to those surrendered. The reload feature is only available, however, if the optionee agrees to defer receipt of the balance of the option shares for at least two years.

Beginning in 2007, our non-employee directors were awarded deferred common shares instead of stock options. The deferred shares vest one year from the date of grant, but receipt is deferred until the latest of (1) three years from the date of grant, (2) retirement from the Board or (3) attainment of the age of 65. We believe deferred shares strengthen the directors’ ties to shareholder interests by providing awards that more effectively build stock ownership and ensure that the directors’ long-term economic interests are aligned with those of other shareholders. In addition, the non-employee directors are subject to the Director Stock Ownership Guidelines, as discussed below.

In 20122014, each non-employee director was awarded 2,8503,162 deferred common shares.shares, subject to a one year vesting condition. Each award approximated $125,000 in value.

The following table details the cash retainers and fees received by our non-employee directors during 20122014, as well as the aggregate grant date fair value of stock grants awarded during 20122014 pursuant to our 1991 Plan:

20122014 Director Compensation

| | | Name | | Fees Earned or

Paid in Cash1 ($) | | Stock Awards2 ($) | | All Other

Compensation3 ($) | | Total ($) | | Fees Earned or

Paid in Cash1 ($) | | Stock Awards2 ($) | | All Other

Compensation3 ($) | | Total ($) |

| Patrick W. Allender | | 77,999 | | 115,539 | | 5,971 | | 199,509 | | 93,334 | | 124,425 | | 14,400 | | 232,159 |

| Roberto Artavia | | | 81,000 | | 124,425 | | 7,557 | | 212,982 |

| Bruce L. Byrnes | | 81,000 | | 115,539 | | 9,163 | | 205,702 | | 82,667 | | 124,425 | | 17,620 | | 224,712 |

| Mei-Wei Cheng | | 81,000 | | 115,539 | | 13,153 | | 209,692 | |

| Phillip R. Cox | | 87,500 | | 115,539 | | 17,371 | | 220,410 | | 85,333 | | 124,425 | | 26,360 | | 236,118 |

| Richard L. Crandall | | 75,000 | | 115,539 | | 17,371 | | 207,910 | | 82,833 | | 124,425 | | 26,762 | | 234,020 |

| Gale S. Fitzgerald | | 87,500 | | 115,539 | | 17,371 | | 220,410 | | 85,000 | | 124,425 | | 25,900 | | 235,325 |

Phillip B. Lassiter4 | | 27,001 | | — | | 12,882 | | 39,883 | |

| John N. Lauer | | 167,000 | | 115,539 | | 19,765 | | 302,304 | |

Gary G. Greenfield4 | | | 48,333 | | 124,425 | | 2,727 | | 175,485 |

| Robert S. Prather, Jr. | | | 78,000 | | 124,425 | | 7,557 | | 209,982 |

| Rajesh K. Soin | | 48,000 | | 115,539 | | 2,437 | | 165,976 | | 79,000 | | 124,425 | | 11,295 | | 214,720 |

| Henry D. G. Wallace | | 100,500 | | 115,539 | | 19,765 | | 235,804 | | 175,667 | | 124,425 | | 28,315 | | 328,407 |

| Alan J. Weber | | 88,500 | | 115,539 | | 17,371 | | 221,410 | | 84,333 | | 124,425 | | 25,900 | | 234,658 |

| |

1 | This column reports the amount of cash compensation earned in 20122014 for Board and committee service, including Board retainer amounts discussed above and the following committee fees earned in 20122014 (partial amounts reflect pro-rated fees based on time of actual Committeecommittee service during 2012)2014, as well as an increase in committee and committee chair fees effective as of May 1, 2014): |

| | | Name | | Audit Committee ($) | | Board

Governance

Committee ($) | | Compensation

Committee ($) | | Investment

Committee ($) | | Special Committee ($) | | Audit Committee ($) | | Board

Governance

Committee ($) | | Compensation

Committee ($) | | Investment

Committee ($) | | Technology Strategy & Innovation Committee ($) |

| Patrick W. Allender | | 7,333 | | 3,333 | | 2,333 | | — | | — | | 21,667 | | 6,667 | | — | | — | | — |

| Roberto Artavia | | | 11,000 | | — | | — | | — | | 5,000 |

| Bruce L. Byrnes | | 11,000 | | 5,000 | | — | | — | | — | | 11,000 | | 6,667 | | — | | — | | — |

| Mei-Wei Cheng | | 11,000 | | 5,000 | | — | | — | | — | |

| Phillip R. Cox | | — | | — | | 12,000 | | 3,000 | | 7,500 | | — | | — | | 17,333 | | 3,000 | | — |

| Richard L. Crandall | | — | | — | | 7,000 | | 3,000 | | — | | — | | — | | 7,333 | | 1,000 | | 9,500 |

| Gale S. Fitzgerald | | — | | 8,000 | | 7,000 | | — | | 7,500 | | — | | 12,667 | | 7,333 | | — | | — |

| Phillip B. Lassiter | | 3,667 | | 1,667 | | — | | — | | — | |

| John N. Lauer | | — | | 5,000 | | 7,000 | | — | | — | |

| Gary G. Greenfield | | | — | | — | | — | | — | | 5,000 |

| Robert S. Prather, Jr. | | | 11,000 | | — | | — | | 2,000 | | — |

| Rajesh K. Soin | | — | | — | | 4,667 | | — | | — | | — | | 6,667 | | 7,333 | | — | | — |

| Henry D. G. Wallace | | 15,000 | | — | | — | | 3,000 | | 17,500 | | — | | 6,667 | | 7,333 | | — | | — |

| Alan J. Weber | | 11,000 | | — | | — | | 5,000 | | 7,500 | | 11,000 | | — | | — | | 8,333 | | — |

| |

2 | This column represents the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 718 for deferred shares granted to our non-employee directors in 2012,2014, as further described above. Each director received 2,8503,162 deferred shares as of April 26, 2012,24, 2014, with a closing price of our common shares on that date of $40.54.$39.35. The actual value a director may realize will depend on the stock price on the date the deferral period ends. As of December 31, 2012,2014, the aggregate number of vested and unvested deferred shares held by our current directors was: Mr. Allender, 5,950;13,312; Mr. Artavia, 7,362; Mr. Byrnes, 8,750; Mr. Cheng, 12,250;16,112; Mr. Cox, 15,950;23,712; Mr. Crandall, 15,950;24,062; Ms. Fitzgerald, 15,950;23,312; Mr. Lauer, 18,050;Greenfield, 3,162; Mr. Prather, 7,362; Mr. Soin, 2,850;10,612; Mr. Wallace, 18,050;25,412; and Mr. Weber, 15,950.23,312. In addition, as of December 31, 2012,2014, the aggregate number of common shares issuable pursuant to options outstanding held by current directors was: Mr. Cox, 9,000; Mr. Crandall, 17,500;9,000; Ms. Fitzgerald, 17,500; Mr. Lassiter, 17,500; Mr. Lauer, 16,500;9,000; Mr. Wallace, 17,500;9,000; and Mr. Weber, 9,000. |

| |

3 | This column represents dividend equivalents paid in cash on deferred shares. |

| |

4 | Mr. Lassiter retired fromGreenfield was elected to the Board effective as of Directors at the 20122014 Annual Meeting of Shareholders.Shareholders in April 24, 2014. |

Director Stock Ownership Guidelines

In 2007,As reported in our 2014 proxy, the Board Governance Committee establishedupdated its stock ownership guidelines for each non-employee director. Underin 2013 to better align with the ownership guidelines, eachpractices of our peer group (discussed further below under “Peer Companies and Competitive Market Data”under “Compensation Discussion and Analysis”). Each non-employee director is expected to own common shares of Diebold valued at least 6,500 common shares.five times the annual retainer and the directors are not permitted to sell any vested shares prior to meeting this ownership level. These ownership guidelines are intended to build stock ownership among non-employee directors and ensure that their long-term economic interests are aligned with those of other shareholders. As reflected below under “Security Ownership of Directors and Management,” the majority of our directors have exceeded the ownership guidelines, while our directors who were appointed most recently are on track to achieve the ownership guidelines within the next few years. We do not impose any penalties on directors who fail to meet the stock ownership guidelines.

CONSIDERATION OF DIRECTOR-NOMINEES

Shareholder Nominees

The policy of the Board Governance Committee is to consider properly submitted shareholder nominations for candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Directors.” In evaluating shareholder nominations, the Board Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under “Board Diversity, Director Qualifications and Corporate Governance Guidelines.”

Any shareholder nominations proposed for consideration by the Board Governance Committee should include:

complete information as to the identity and qualifications of the proposed nominee, including name, address, present and prior business and/or professional affiliations, education and experience, and particular fields of expertise;

an indication of the nominee’s consent to serve as a director of Diebold if elected; and

why, in the opinion of the recommending shareholder, the proposed nominee is qualified and suited to be a director of Diebold.

Shareholder nominations should be addressed to Diebold, Incorporated, 5995 Mayfair Road, P.O. Box 3077, North Canton, Ohio 44720-8077, Attention: Corporate Secretary. See also “Shareholder Proposals” below.

Identifying and Evaluating Nominees for Directors

The Board Governance Committee considers many methods for identifying and evaluating director-nominees. The Board Governance Committee regularly reviews the appropriate size of the Board and whether any vacancies on the Board are anticipated due to retirement or otherwise. When vacancies arise or are anticipated, the Board Governance Committee considers various potential candidates. Candidates may come to the attention of the Board Governance Committee through current Board members, professional search firms, shareholders or other persons. Specifically, in 2012, the Board Governance Committee engaged Heidrick & Struggles, a global board- and executive-level search firm, to assist with identifying potential director candidates.

As described above, the Board Governance Committee considers properly submitted shareholder nominations for candidates for the Board. Following verification of the recommending shareholder’s status, recommendations are considered by the Board Governance Committee at a regularly scheduled meeting.

Majority Voting Policy

In 2007, the Board adopted a majority voting policy, which provides that, in an uncontested election, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” election, which we refer to as a Majority Withheld Vote, is expected to tender his or her resignation following certification of the shareholder vote. The Board Governance Committee will then consider the tendered resignation and make a recommendation to the Board.Board as to whether to accept or reject the tendered resignation. The Board will act on the Board Governance Committee’s recommendation within 90 days following certification of the shareholder vote. Any director who tenders his or her resignation pursuant to this policy will not participate in the Board Governance Committee recommendation or Board action regarding whether to accept or reject the tendered resignation.

However, if each member of the Board Governance Committee received a Majority Withheld Vote in the same election, then the Board will appoint a committee comprised solely of independent directors who did not receive a Majority Withheld Vote at that election to consider each tendered resignation offer and recommend to the Board whether to accept or reject each resignation. Further, if all of the directors received a Majority WithholdWithheld Vote in the same election, then the Board will appoint a committee comprised solely of independent directors to consider each tendered resignation offer and recommend to the Board whether to accept or reject each resignation.

Board Diversity, Director Qualifications and Corporate Governance Guidelines

In evaluating director-nominees, the Board Governance Committee considers many factors it deems appropriate,in order to strengthen the talent and capabilities of the Board, and any committees, consistent with our Corporate Governance Guidelines and other criteria established by the Board. While the Board Governance Committee does not have a formal diversity policy, its general goal is to create a well-balanced Board team that combines diversebroad business and industry experience skill setswith comprehensive diversity characteristics and other leadership skills, that represent diverse viewpoints and that enablesprofessional viewpoints. Together, these considerations enable us to appropriately pursue our strategic objectives domestically and abroad.

The Board Governance Committee identifies candidates whose business experience, knowledge, skills, diversity, integrity and global experiences are considered desirable to strengthen the talent and capabilities of the Board and any committees of the Board. Qualifications for Board service have not been reduced to a checklist of specific standards or minimum qualifications, skills or qualities.

The However, the Board Governance Committee makes its determinations as to director selection based on the facts and circumstances at the time of the receipt of the director candidate recommendation. Applicable considerations include whether:

the Board Governance Committee is currently looking to fill a new position created by an expansion of the number of directors, or a vacancy that may exist or is anticipated on the Board;

the current composition of the Board is consistent with the criteria described in our Corporate Governance Guidelines;

whether the candidate possesses the qualifications that are generally the basis for selection of candidates to the Board;Board, including the candidate’s applicable experience, skill set and diversity qualifications, as noted above, in order to support the current and future needs of the Company; and

whether the candidate would be considered independent under the rules of the SEC, NYSE and our standards with respect to director independence.

Final approval of any candidate is determined by the full Board. In addition, the Board Governance Committee annually conducts a reviewperformance and contributions of each incumbent directors usingdirector are assessed as part of the same criteriaBoard’s annual assessment program, as outlineddiscussed above in order to determine whether a director should be nominated for reelection to the Board.“Board and Director Assessments.”

A copy of our Corporate Governance Guidelines is available on our web site at http://www.diebold.com.

The Board Governance Committee has identified the director-nominees below as fitting the general qualifications described above, and in particular, due to the specific experience, skills and qualifications each of them would bring or continue to bring to the Board as set forth in more detail below.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board recommends that its ten nominees for director be elected at the 20132015 Annual Meeting, each to hold office for a term of one year from the date of the Annual Meeting or until the election and qualification of a successor. In the absence of contrary instruction, the Proxy Committee will vote the proxies for the election of the ten nominees.

All director-nominees are presently members of the Board with the exception of Mr. Artavia, who was identified as a director-nominee by the Board Governance Committee, and Mr. Prather, who was properly nominated by a shareholder of the company and, after review, recommended by the Board Governance Committee. All of the present members of the Board were previously elected by our shareholders. A substantial majorityAll of the director-nominees, except for Andreas W. Mattes, our President and CEO, are independent as requireddefined by the corporate governance standards of the NYSE. While Diebold does not have a formal policy regarding directors’ attendance at the Annual Meeting of Shareholders, it is expected that all directors attend the Annual Meeting unless there are extenuating circumstances for nonattendance. All directors standing for reelection attended the 2012 Annual Meeting of Shareholders, except for Mr. Soin who had a prior engagement.

If for any reason any director-nominee is not available for election when the election occurs, the Proxy Committee, at its option, may vote for substitute nominees recommended by the Board. Alternatively, the Board may reduce the number of director-nominees. The Board has no reason to believe that any director-nominee will be unavailable for election when the election occurs.

Recommendation of the Board

The board recommends a vote FOR the election of our ten nominees as directors.

The Director-Nominees are:

|

| | |

| Name, Term and Age | | Position, Principal Occupation, Business Experience and Directorships Last Five Years, and Qualifications to Serve |

Patrick W. Allender Director since 2011

Age — 6668 | | February 2007: Retired Executive Vice President, Chief Financial Officer and Secretary, Danaher Corporation, Washington, D.C. (diversified manufacturing); 2005 - 2007: Executive Vice President, Chief Financial Officer and Secretary, Danaher Corporation.

Currently a director of Colfax Corporation, Fulton, Maryland (diversified industrial products) since 2008, where he serves as Chair of the Governance Committee and a member of the Audit Committee; and Brady Corporation, Milwaukee, Wisconsin (identification solutions) since 2007, where he serves as Chair of the Finance Committee, and a member of the Audit and Nominating Committees.Committees; and Colfax Corporation, Fulton, Maryland (diversified manufacturing) since 2008, where he serves as Chair of the Governance Committee and a member of the Audit Committee.

Chair of our Audit Committee and member of our Board Governance Committee.

Mr. Allender’s 18 years as Chief Financial Officer of a large publicly tradedpublicly-traded company with global operations provides our Board with valuable expertise in financial reporting and risk management. In addition, as a result of Mr. Allender’s public accounting background, including as audit partner of a major accounting firm, he is exceptionally qualified to serve as Chair of our Audit Committee. |

| |

|

| | |

Name, Term and Age | | Position, Principal Occupation, Business Experience and

Directorships Last Five Years, and Qualifications to Serve

|

Roberto Artavia

Director-nominee

Age — 54

| | 2008 - Present: Chairman and CEO of Fundación Marviva, and Chairman of Marviva Foundation, each not-for-profit organizations dedicated to the protection of marine resources in the Americas and Mid-eastern Pacific, respectively; Protector of AVINA Foundation; 2005 - Present: Board member of Copa Holdings, S.A. (airline industry).

Also currently Chairman of Viva Trust, and President of Fundación Latinoamérica Posible, each dedicated to the promotion of sustainable development, integration and social responsibility in Latin America. He is also a Director and CEO of the Global Social Competitiveness Index Initiative, Inc., based in Washington, D.C. From 1999-2007, he served as Rector of INCAE Business School, a school of business with operations in 12 Latin American countries, where he served as Dean from 1994-1996. He also served as an academic researcher for Harvard Business School from 1987-2001.

Mr. Artavia’s academic and philanthropic experience within the business sector is a tremendous asset, particularly in Latin America, a market where we continue to focus on growth.

|

| |

|

| | |

Bruce L. Byrnes

Director since 2010

Age — 65

| | July 2008: Retired Vice Chairman of the Board, Procter & Gamble, Inc., Cincinnati, Ohio (consumer goods); 2004-2007: Vice Chairman of the Board, Household Care, Procter & Gamble, Inc.

Currently a director of Cincinnati Bell Inc., Cincinnati, Ohio (telecommunications) since 2003, where he serves as Chair of the Governance and Nominating Committee; Boston Scientific Corp., Natick, Massachusetts (medical devices) since 2009, where he serves as Chair of the Governance and Nominating Committee, and a member of the Audit Committee; and Brown-Forman Corporation, Louisville, Kentucky (wine and spirits) since 2010, where he serves as a member of the Audit, and Governance and Nominating Committees. Formerly a director of Procter & Gamble from 2002 - 2008.

Member of our Audit and Board Governance Committees.

Mr. Byrnes’ qualifications to sit on our Board include his 38 years in various leadership roles of an $80 billion global business, including his extensive marketing and strategy experience, and profit and revenue responsibility at Procter & Gamble. Further, as a result of Procter & Gamble’s business-to-consumer focus, he brings a different perspective to our Board and our business-to-business focus.

|

| |

Phillip R. Cox Director since 2005

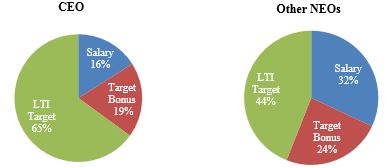

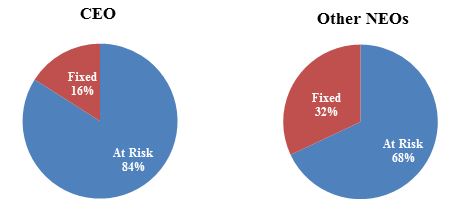

Age — 6567 | | 1972 – Present: President and Chief Executive Officer, Cox Financial Corporation, Cincinnati, Ohio (financial planning and wealth management services).